Investment gold - A safe and increasingly popular investment in Croatia

Gold in the form of gold bars and gold coins categorized as investment gold in the world has been the ideal choice of small investors looking for a safe investment resistant to crises, recessions, wars and inflation for decades. In addition, investing in gold it is significantly more profitable than term savings.

The price of gold it grows by more than 8% annually (average growth in the last 20 years), and during the recession the price of this extremely sought-after precious metal used to rise by over 30% annually. Due to the growth of shares in foreign markets that has lasted for a whole decade, in the last few years more and more people are choosing to invest in investment gold.

Another big reason why more and more Croats are investing in gold is that it is exempt from the capital gains tax of 10% per year.

Why is investment gold considered the safest form of investment?

Kwhen talking about safe investments, most people think of real estate or fixed-term bonds savings. However, these forms of investing money have flaws that can result in the loss of the entire or almost entire investment. Investment gold is one way to reduce this risk. See below for a comparison of different ways of investing money in the long term.

Term savings

This form of investment really belongs to the category of relatively safe investments, but it should be kept in mind that it is usually unprofitable. Interest rates are very low and usually do not cover the inflation rate. In the long run, this leads to a loss of capital value, which even financially ignorant people intuitively know and formulate in the way "In the past, 100 German marks were worth more than today 100 euros".

No matter which bank it is, there is a probability of bank failure, with depositors losing their stake. During the financial crisis that began in 2008, some of the world's largest banks failed, and many others were saved at the last minute by the intervention of nation states.

Some will say that there is no danger when saving in Croatian banks, because the deposit insurance fund guarantees an amount of up to 100.000 euros to each depositor, but there is a catch. The payment would be in the equivalent value in Croatian kuna, and there is no guarantee that the exchange rate will be favorable. Deposit Insurance Act - Article 7:

"(1) Every depositor of a credit institution who is the holder of an acceptable deposit from Article 5, paragraph 1 of this Act, at the moment when an insured event occurs in that credit institution, has the right to compensation up to and including EUR 100.000 in kuna equivalent, according to the average course Croatian National Bank valid on the day of occurrence of the insured event."

So, if there was a financial collapse of the state due to war, natural disaster, etc., savers would indeed receive compensation, but who knows at what exchange rate. You don't have to go far for an example of such a disaster. It is enough to remember the fall in the value of the Yugoslav dinar, which became a completely worthless currency. There are many similar examples in the world, and those who believe that this is an impossible scenario for the kuna or even the euro, should study how currencies without gold backing have gone through history.

Investing in real estate

Even real estate is not a guarantee of capital preservation in the long term. Namely, the value of houses and apartments decreases over time due to the limited lifespan of the materials from which they were built. Renovations can extend the service life, but this requires additional investments. An additional risk for real estate is fires, floods, storms and earthquakes that can completely destroy the real estate. Of course, there are insurances that can be used to protect against natural disasters, but this again requires additional investments.

We should not ignore the possibility of war, nationalization or local problems that can bring down the value of real estate, such as the opening of a noisy nightclub in the neighborhood or the opening of economic facilities such as refineries, slaughterhouses, etc., which significantly reduce interest in buying real estate in the neighborhood.

Even under ideal conditions, real estate is usually a very illiquid asset. If the owner wants to sell them urgently, he must agree to a significantly lower price than the real value. Besides, investment in real estate as a rule, it is only possible for the richest, while everyone can invest in investment gold.

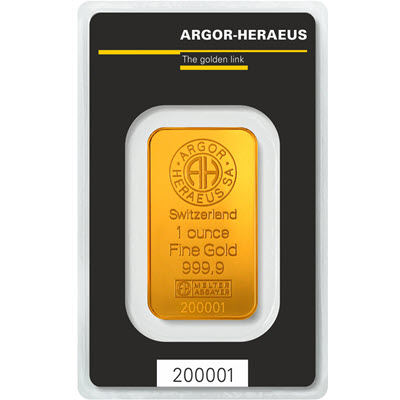

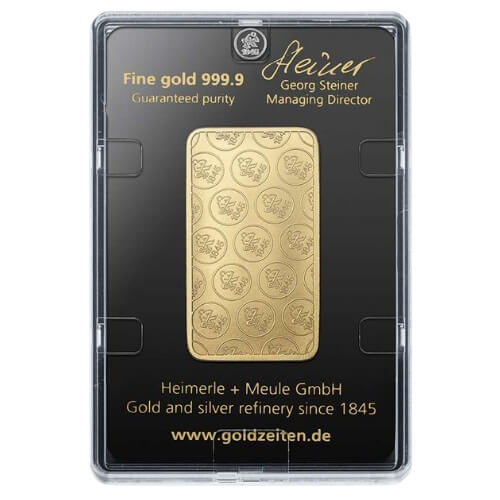

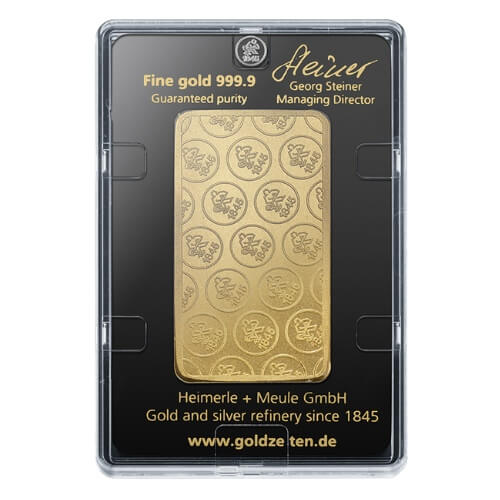

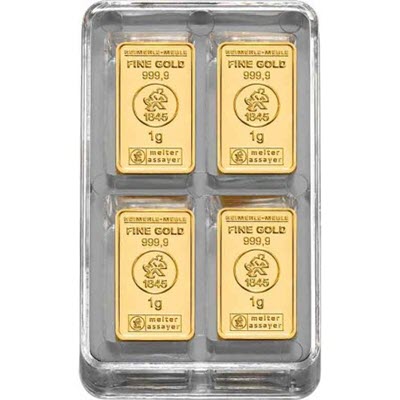

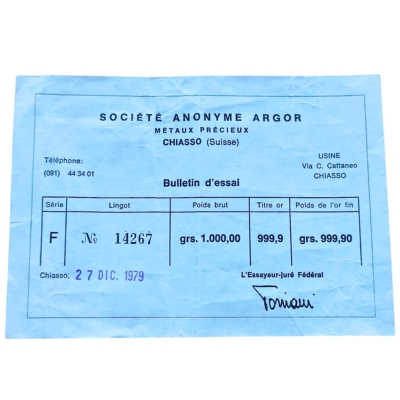

Buying investment gold

All mentioned risks can be avoided by investing money in investment gold, i.e. gold bars or gold coins. Namely, unlike savings in a bank that can fail due to the financial collapse of the state, you always keep gold where you want, so you don't have to worry about the stability of the financial sector. On the contrary, in economic recessions or times of political instability, the value of gold and other precious metals tends to increase.

Seven reasons to invest in investment gold

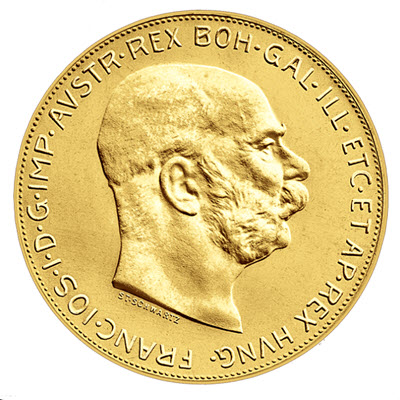

Investing in investment gold and silver has always been a good way to preserve value. At the time of globally present currencies such as the US dollar, the euro, the British pound, and the quick and easy transfer of capital via the Internet to shares, investment funds, cryptocurrencies, etc., many believe that the era of precious metals has passed. But precisely because most people do not currently own precious metals, it is an ideal time to invest in investment gold in the form of bullion, as well as in coins such as, for example, the Austrian gold ducats. Below, read the reasons why the price of gold and other precious metals should rise in the coming years:

1. Global debt is unpayable

State debt and citizens is growing in almost all countries of the world. Due to the functioning model of modern monetary systems, the debt is impossible to repay. There are only two ways to reduce the amount of debt. The first is the printing of new fiat money, which will make existing money lose value (inflation or hyperinflation will occur), and the second way is massive debt write-offs - countries simply won't pay their debts, whereby many financial institutions and their depositors will lose part or all of their stake. In both scenarios, the price of gold, silver, platinum and other precious metals will rise significantly.

2. Increasing demand from developing countries

If global economic growth is high and the purchasing power of people in developing countries (such as China and India) continues to rise, so will interest in buying gold. Namely, many people who are aware of the value of gold simply cannot afford it. If hundreds of millions of people in poor countries get out of poverty and acquire some capital, some of them will decide on a safe investment - investing in investment silver or gold in the form of bars.

3. In an age of increasing control, it gives independence

States and financial institutions such as banks are imposing more and more control over the flow of capital and, in general, over the daily lives of average citizens. As control grows, so does the possibility of misuse of information or even theft of financial assets. Since gold bars or gold coins you can store wherever you want and for however long you want, investing in investment gold provides a much greater degree of anonymity and independence from banks and the state.

4. Metals are physically very resistant

Paper money it loses value over time due to inflation, and can also be completely destroyed by fire, water, intentional or accidental tearing of banknotes. Digital money in a bank account is at risk of hacker attack and theft, as well as at the risk of being blocked by the bank or state institutions. Gold is physically almost indestructible. It is resistant to moisture, fire, many acids and does not rust, which means that in a thousand years it will be in the same condition as it is today.

5. Universally recognized as a desirable asset

Have you ever tried to pay in Croatian kuna in a foreign country? Probably not, because you know that kuna are worth nothing outside the borders of Croatia, except in a few banks and exchange offices. In more distant countries, you cannot exchange them even at the exchange office. The same problem arises when you try to exchange Vietnamese or Chilean currency in Croatia - an impossible mission, because the unusual colorful pieces of paper are not recognized as something valuable. There are no such problems with gold. It is recognized worldwide as a desirable asset and you will be able to easily exchange it for local currency or other valuable assets, especially if it is in the form of gold bars or gold coins.

6. It is portable unlike real estate

Other physical assets (houses, apartments, land) can lose value due to a whole series of events such as wars, floods, construction of dirty factories or noisy roads. The decline in value occurs due to the inability to transfer such assets to another location. Portability is another important characteristic of gold and silver. A small amount of these metals contains a lot of value, so it is very easy to put it in your pocket or bag and take it wherever you want. Since other people also value this characteristic, they will always be willing to buy investment gold.

7. In the long term, it brings a higher yield than savings

Since every country in the world is constantly increasing the amount of money in circulation, every currency is constantly losing value. Even interest rates on savings do not cover the decline in purchasing power, which is why wise people have always opted for investing in gold. In the long term, the return on owning gold is much higher than the return on interest on savings. When it comes to high-purity investment gold, the price has been rising on average over the past twenty years 7% per year.

World powers that invest in gold

Gold has always been the money of kings and rich people. Although nowadays every country in the world has left gold standard and does not cover the value of paper money with a precious metal, wealthy people still prefer investment gold as an ideal way to preserve their capital. Robert Kiyosaki, famous author of the book "Rich father - poor father", says: "Gold is a magnet for wealth. Therefore, if someone wants his income to grow, he just needs to invest in this precious metal."

Since one of the reasons for buying gold is anonymity and achieving independence from the economic situation of the country, the vast majority of bullion buyers do not like to talk publicly about whether they own it and how much. But analyzing statistical data on the sale of precious metals in certain countries, it can be concluded that in recent years the Germans have become the biggest buyers of this precious metal. Namely, during 2016, German citizens bought approximately 175 metric tons of coins and investment bullion. The value of that gold was approximately 7 billion euros. The German government also wants to get as much of the said precious metal as possible. In the last four years, Germany has returned 674 metric tons of gold bars from New York and Paris, and has become the second country in the world in terms of reserves, right after the USA.

But let's go back to individuals. One of the most famous private investors in precious metals is billionaire George Soros. In 2016, his fund invested 264 million dollars in the shares of the then largest mining company that mines precious metals - Barrick Gold. Soros also bought more than a million options to buy shares in the fund that tracks the price of gold - the SPDR Gold ETF.

John Paulson, an American investor and fund manager invests even more in metals. His fund has invested approximately 1,5 billion dollars in the yellow precious metal through financial derivatives and shares of companies dealing in gold. During 2009, he stated: “Due to concerns about the dollar, we were looking for another currency to denominate our investments. But we found that with other currencies like the British pound or the euro, the situation is just as bad. Due to the uncertainty associated with all paper currencies, we have concluded that investment gold is the best and safest currency.”

Stanley Druckenmiller is one of the most successful investors in history. His fund in the period from 1986 to 2010, when he closed the fund and retired, had an average annual return of as much as 30%, and in that period he never had a year in which he made a loss. He holds 20% of his private portfolio in gold bars.

Ray Dalio, another Wall Street fund manager, on one occasion he stated: "If you don't own gold, you don't know anything about economics or history." Although it is not known how much bullion he owns, there should be no doubt that a significant part of this investor's portfolio is linked to gold.

The Rothschild family, considered by many to be the richest family in the world, also prefers investing in precious metals. Their fund Rothschild Investment Trust (RIT) Capital Partners is required by law to publish financial reports, and in 2016 one of the reports stated "The share of the fund invested in investment gold and other precious metals has increased to 8% of the fund's value by the summer".

David Einhorn, manager of investment fund management company Greenlight Capital, also invests heavily in precious metals. At the beginning of 2017, he stated that investment gold is his top position in the funds, as well as: "All our 6 funds own physical gold bars".

Controversial American president Donald Trump also values gold. On one occasion, he authorized his own company to accept as a deposit from a business partner three bars of 32 ounces of gold, which at that time were worth 176 thousand dollars. He publicly stated, “Reinstating the gold standard would be difficult to implement, but it would be a great decision. We would have a standard on which to base our money.”

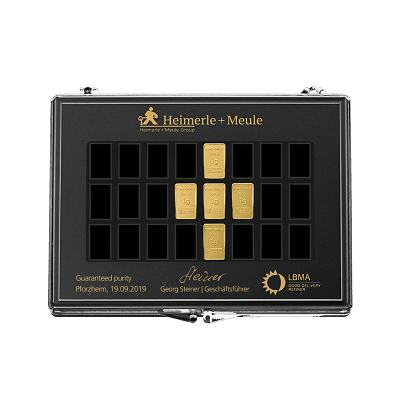

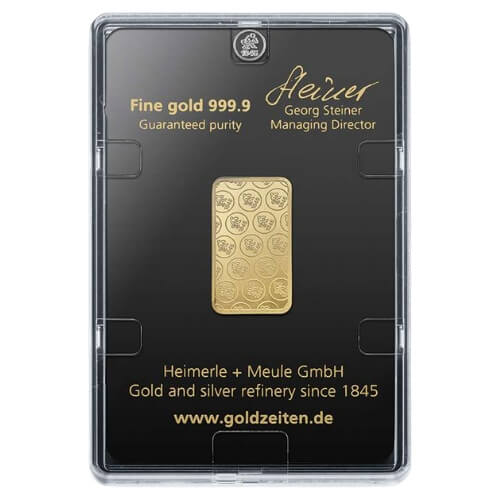

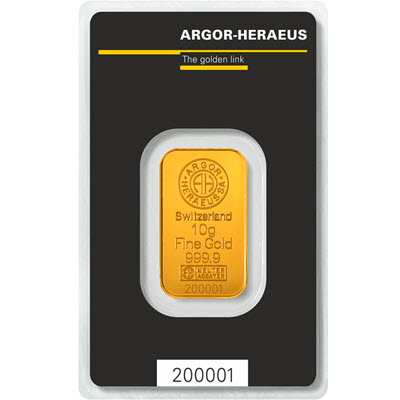

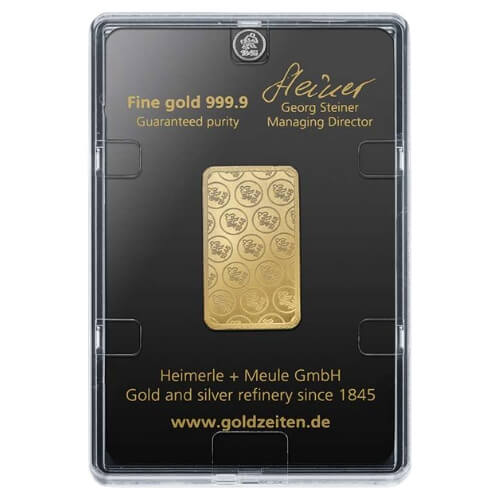

If you are interested in investing in investment gold, we invite you to take a look at our offer gold bars or investment gold coins. Feel free to contact us if you have any questions about our products or investing in gold in general, and check out our range at the top of this page!

Notes:

- Every reference on this page to "Centar Zlata" refers to the company Saiva doo

- The texts on centarzlata.com serve exclusively to inform and educate about financial and precious metal markets and should not be considered as investment advice.

_____

Would you like to receive similar texts to your email address? Sign up to receive our newsletters! In the newsletters, in addition to educational texts, we also send information about our company promotive activities, as well as other information that we believe may be of interest to those interested in investing in precious metals!